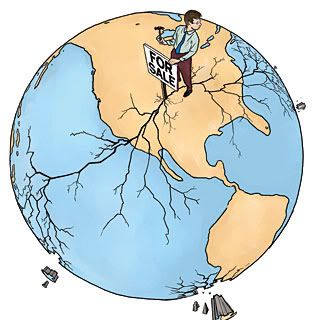

Ill. “Blackouts and Cascading Failures of the Global Markets”,

Ill. “Blackouts and Cascading Failures of the Global Markets”,

Scientific American.

The credit crunch is dragging down the global economy and raising political tensions

Collapsing credit has plunged the world economy into the deepest recession in more than 70 years. What began as a property bubble in the US has spread rapidly as troubled banks have stopped lending and consumers and businesses have stopped spending. As demand in the US and Europe evaporates, once-thriving emerging markets are losing their best customers and biggest investors. An increasingly synchronised global economy will contract in 2009 for the first time since World War II.

Eighteen months after it began, this economic chain reaction—from banks to markets to consumers to companies—is entering a new phase. Economic pain, reflected in millions of lost jobs and destroyed savings, has entered the political realm, causing some governments to collapse and threatening others. The risk of political instability is leading to a wave of trade protectionism, which is rippling across the globe. It was just such a political response in the 1930s, exemplified by America’s infamous Smoot-Hawley tariffs, that deepened and prolonged the Great Depression.

Source: “Introduction: Banks, busts and batons”, The Economist Intelligence Unit. Download the entire report “Manning the barricades: Who’s at risk as deepening economic distress foments social unrest” (PDF).

793 thoughts on “Manning the barricades”

Comments are closed.